archikld.ru

Tools

Bito Etf

ProShares, a premiere provider of ETFs, plans to launch the first bitcoin-linked ETF in the United States (NYSE Ticker: BITO) tomorrow, October 19, BITO - ProShares Trust - ProShares Bitcoin Strategy ETF Stock - Stock Price, Institutional Ownership, Shareholders (ARCA). BITO is the first U.S. exchange-traded fund that seeks to correspond to the performance of bitcoin. BITO invests in bitcoin futures and does not invest in. The ProShares Bitcoin Strategy ETF is bitcoin-linked ETF offering investors an opportunity to gain exposure to bitcoin returns in a convenient, liquid and. In depth view into BITO (ProShares Bitcoin Strategy ETF) including performance, dividend history, holdings and portfolio stats. View ProShares Bitcoin Strategy ETF (BITO) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Get ProShares Bitcoin Strategy ETF (BITO:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. Your browser is unsupported · PROSHARES TRUST BITCOIN STRATEGY ETF BITO · The ETF Newsletter You Can't Miss Out On. Uncover the latest ETF insights. BITO provides exposure to bitcoin returns in an ETF wrapper. The fund does not invest directly in bitcoin. The fund will invest in cash settled, front-month. ProShares, a premiere provider of ETFs, plans to launch the first bitcoin-linked ETF in the United States (NYSE Ticker: BITO) tomorrow, October 19, BITO - ProShares Trust - ProShares Bitcoin Strategy ETF Stock - Stock Price, Institutional Ownership, Shareholders (ARCA). BITO is the first U.S. exchange-traded fund that seeks to correspond to the performance of bitcoin. BITO invests in bitcoin futures and does not invest in. The ProShares Bitcoin Strategy ETF is bitcoin-linked ETF offering investors an opportunity to gain exposure to bitcoin returns in a convenient, liquid and. In depth view into BITO (ProShares Bitcoin Strategy ETF) including performance, dividend history, holdings and portfolio stats. View ProShares Bitcoin Strategy ETF (BITO) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Get ProShares Bitcoin Strategy ETF (BITO:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. Your browser is unsupported · PROSHARES TRUST BITCOIN STRATEGY ETF BITO · The ETF Newsletter You Can't Miss Out On. Uncover the latest ETF insights. BITO provides exposure to bitcoin returns in an ETF wrapper. The fund does not invest directly in bitcoin. The fund will invest in cash settled, front-month.

Get detailed information about the ProShares Bitcoin ETF, view the latest price. Create real-time notifications and price alerts. View the latest ProShares Bitcoin Strategy ETF (BITO) stock price and news, and other vital information for better exchange traded fund investing. BITI, the first short bitcoin strategy ETF, offers investors the potential to profit on days when bitcoin drops. Proshares Bitcoin Strategy ETF stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Find the latest quotes for ProShares Bitcoin Strategy ETF (BITO) as well as ETF details, charts and news at archikld.ru View the real-time BITO price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Performance charts for ProShares Bitcoin Strategy ETF (BITO - Type ETF) including intraday, historical and comparison charts, technical analysis and trend. Explore BITO for FREE on archikld.ru: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. BITO is an actively managed ETF. The fund's objective is to achieve capital appreciation through exposure to Bitcoin. BITO mainly buys Bitcoin futures contracts. BITO ETF in-depth analysis and real-time data such as the investment strategy, characteristics, ETF Facts, price, exposure, AuM, Expense Ratio, and more. Learn everything about ProShares Bitcoin Strategy ETF (BITO). News, analyses, holdings, benchmarks, and quotes. View the basic BITO option chain and compare options of ProShares Bitcoin Strategy ETF on Yahoo Finance. ProShares Bitcoin Strategy ETF (BITO) Dividend History. Data is currently not available. Ex-Dividend Date 09/03/ Dividend Yield %. Active ETF. BITO ; Price as of: AUG 30, PM EDT. $ - $ - % ; Primary Theme. N/A ; fund company. ProShares. ProShares Bitcoin Strategy ETF BITO actively manages a portfolio of front-month CME bitcoin futures. Get the latest ProShares Bitcoin Strategy ETF (BITO) real-time quote, historical performance, charts, and other financial information to help you make more. ProShares Bitcoin Strategy ETF This metric is not yet available. not track an index. Dividend policy. This share class generates a stream of income by. Get detailed information about the ProShares Bitcoin ETF, view the latest price. Create real-time notifications and price alerts. About BITO The ProShares Bitcoin Strategy ETF (BITO) is an exchange-traded fund that mostly invests in long btc, short usd currency. The fund actively manages. The ProShares Bitcoin Strategy ETF (USD) is a(n) Cryptocurrencies Exchange Traded Funds (ETF) seeks to invest in Undefined sector located in Global. The.

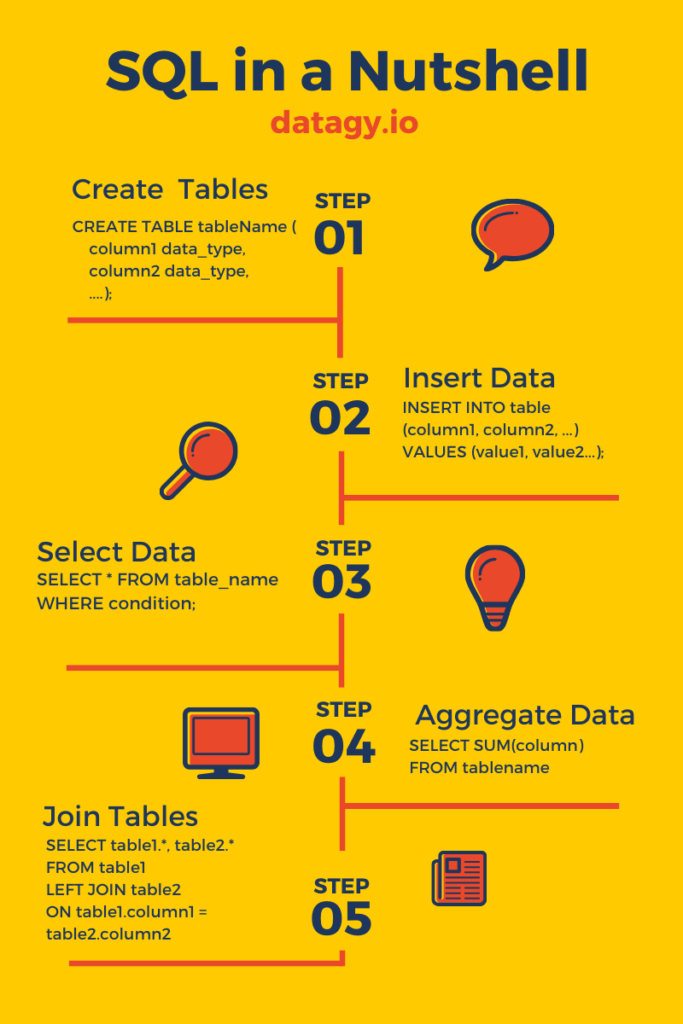

How Hard Is Learning Sql

SQL is not a difficult language to learn, and the basics can be picked up in 2 weeks if you're diligent. SQL isn't hard to learn either. Even if you don't know any other programming languages, it won't take long to gain a decent understanding of SQL. However, there. Learning SQL can be challenging due to advanced concepts such as recursive queries, query tuning, temporary functions, and self-joins. Enrolling in live online. I'd recommend learning standard SQL before SQLite's version of SQL. SQLite allows a lot of things (such as automatic type conversions and. I would recommend you to learn SQL practices, hand written preferably, so to get yourself familiar with the language, there are of course wizards tools for. Learning SQL can be tough. archikld.ru is an interactive set of exercises that provide a hands-on set of exercises to help learn SQL. If you are thinking of upskilling or just curious about how difficult it would be to pick up SQL in your career goals, you are in for a. Learn SQL The Hard Way is a crash course in the basics of SQL to store, structure, and analyze data. With this book you can understand what is going on in your. SQL is not hard to learn - especially when compared to learning other programming languages due to its simple syntaxes and easier grammar. With a few weeks of. SQL is not a difficult language to learn, and the basics can be picked up in 2 weeks if you're diligent. SQL isn't hard to learn either. Even if you don't know any other programming languages, it won't take long to gain a decent understanding of SQL. However, there. Learning SQL can be challenging due to advanced concepts such as recursive queries, query tuning, temporary functions, and self-joins. Enrolling in live online. I'd recommend learning standard SQL before SQLite's version of SQL. SQLite allows a lot of things (such as automatic type conversions and. I would recommend you to learn SQL practices, hand written preferably, so to get yourself familiar with the language, there are of course wizards tools for. Learning SQL can be tough. archikld.ru is an interactive set of exercises that provide a hands-on set of exercises to help learn SQL. If you are thinking of upskilling or just curious about how difficult it would be to pick up SQL in your career goals, you are in for a. Learn SQL The Hard Way is a crash course in the basics of SQL to store, structure, and analyze data. With this book you can understand what is going on in your. SQL is not hard to learn - especially when compared to learning other programming languages due to its simple syntaxes and easier grammar. With a few weeks of.

The good news is that learning SQL is relatively easy. It's a lot simpler than programming languages like C++ or JavaScript, and it's not an overly long process. Learn SQL Quickly: A Beginner's Guide to Learning SQL, Even If You're New to Databases (Crash Course With Hands-On Project) [Quickly, Code] on archikld.ru SQL: While SQL also has a strong community, its support is often more fragmented due to the various dialects (e.g., MySQL, PostgreSQL, SQL Server). Each DBMS. Learn to answer questions with data using SQL. No coding experience necessary. SQL is not difficult to learn. It's actually quite easy once you know the syntax of the language. Most people start with an online SQL tutorial. Advanced SQL. Take your SQL skills to the next level. 4 hours to go. Begin Course. Courses Discussions. Lessons. 1. JOINs and UNIONs. Reads like an owners manual. definately not a "SQL for Dummies" type book. The exercises, at the end of each chapter, do help at times but at other times can be. Take an SQL course on Udemy and learn how to build and analyze a variety of SQL databases. Learn from real-world experts with step-by-step video tutorials. Steps you must take to prepare to learn and apply SQL. · Identifying a SQL dialect to learn · Finding an IDE · Making a (realistic) learning plan. learning SQL. Microsoft SQL Server Express edition. This has fewer features than the Developer edition. However, it installs more quickly in less hard drive. Its ease of learning and use will depend on your familiarity with a few computer-related subjects, especially databases. SQL is not very hard to learn. If you practice a little every day, you will get better over time. There are many resources that make learning. SQL is relatively easy to learn compared to other programming languages. Many people who are new to programming can learn the basics of SQL in a short amount of. Is SQL hard to learn? It can be. But with the right approach and a little stubborn determination, it might just become your favourite way to solve problems. You get the idea now. SQL is hard to master, and even more so if you miss the first steps. I got you here. You need to make sure you understand the. Learning SQL is fit for beginners, and requires no previous coding experience. Is SQL hard to learn? SQL is considered easier to learn than many other. SQL is a language used for a database to query data. In this introductory course, you'll learn the basics of the SQL language and the relational databases. You'. SQL is a more accessible programming language to learn but also a bit challenging to master. Being a proficient SQL developer is even harder, given the broader. SQL is not a difficult language to learn, and the basics can be picked up in 2 weeks if you're diligent. If you want to know about databases, then sure: learn SQL (such as TSQL) - but understand the differences. Databases are good if you need to.

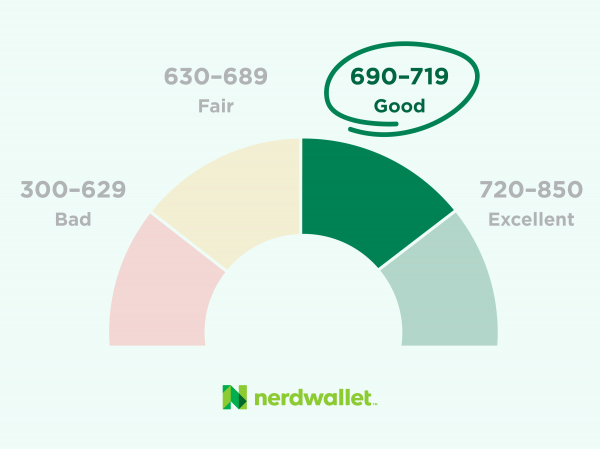

690 Credit Score Home Loan

myFICO Loan Center provides free information on home loans, refinance, home FICO, myFICO, Score Watch, The score lenders use, and The Score That. With a credit score of , you have the option to get conventional mortgages, Jumbo, Super Jumbo, FHA, Va, USDA, Non-QM, and hard money loans. Lendersa can. A FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. If your score is below , you are required to pay a 10% down payment to qualify for loans. If you have a fair or bad credit score, an FHA loan might be your. For instance, if your credit report shows , , and , then is your middle score. If you are applying with someone else, the lender will use the lower. In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. Yes, a credit score of will in most cases enable you to be approved for a mortgage and offered good interest rates. However, there are a few lenders that actually cater to applicants with lower credit scores in the poor/fair range ( and below for the FICO® Score model, and. A credit score is considered fair to good. While not the highest, it's generally eligible for many lending options. Down Payment: For mortgages, a larger. myFICO Loan Center provides free information on home loans, refinance, home FICO, myFICO, Score Watch, The score lenders use, and The Score That. With a credit score of , you have the option to get conventional mortgages, Jumbo, Super Jumbo, FHA, Va, USDA, Non-QM, and hard money loans. Lendersa can. A FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. If your score is below , you are required to pay a 10% down payment to qualify for loans. If you have a fair or bad credit score, an FHA loan might be your. For instance, if your credit report shows , , and , then is your middle score. If you are applying with someone else, the lender will use the lower. In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. Yes, a credit score of will in most cases enable you to be approved for a mortgage and offered good interest rates. However, there are a few lenders that actually cater to applicants with lower credit scores in the poor/fair range ( and below for the FICO® Score model, and. A credit score is considered fair to good. While not the highest, it's generally eligible for many lending options. Down Payment: For mortgages, a larger.

VA lenders typically require a FICO score of at least High loan amounts, such as those exceeding $1 million, may require a higher credit score. Scores between and are considered “good” credit; Scores between and are considered “fair” credit”; Scores of or lower are considered “poor. Most lenders prefer good or excellent credit (usually FICO and above), but there are some who will accept bad credit (below ). According to. Can I get a mortgage with a credit score? Credit reference agencies such as Equifax and Experian have scoring systems which classify scores of as fair. A FICO score means that your credit is good, though a bit lower than the current national average of You will likely qualify for loans and loans of. Lenders generally view those with credit scores of and up as acceptable or lower-risk borrowers. to Fair Credit Score Individuals in this category. Scores between and are considered “good” credit; Scores between and are considered “fair” credit”; Scores of or lower are considered “poor. The minimum credit score needed to buy a house can range from to , but will ultimately depend on the type of mortgage loan you're applying for and your. Higher FICO® Scores save you money on loans by qualifying you for lower interest rates, which can save you thousands over the life of the loan. Lenders often require a credit score of at least and a minimum down payment of 5% to qualify for a Conventional loan while an FHA loan may be available with. Around 25% to 30% of first mortgages go to borrowers with credit score below , depending on the year, so you should be able to finance your home purchase. FHA: Financing is based on the lower middle score of each borrower. For example, if borrower 1 has a , , and and borrower 2 has a , and Lenders generally view those with credit scores of and up as acceptable or lower-risk borrowers. to Fair Credit Score Individuals in this category. Minimum Credit Score for FHA Loans. The minimum FICO score for an FHA loan through Carlson Mortgage is , with a % minimum down payment. Other lenders may. A rate-and-term refinance for a conventional mortgage loan typically requires at least a credit score — that is, as long as your loan-to-value ratio is 75%. Generally, a score between and means you have bad credit, to means you have fair credit, to is good credit, and up is excellent. However, there are a few lenders that actually cater to applicants with lower credit scores in the poor/fair range ( and below for the FICO® Score model, and. A score of is considered “Good.” With a credit score, getting a mortgage, vehicle loan, or personal loan is very simple. Because it is less hazardous. Using the same example of the two co-borrowers with credit scores of home ownership – one loan at a time. Our team of mortgage experts build. Minimum credit score requirements for mortgages can vary depending on the type of home loan you want and the lender you work with to secure financing. · A is.

Invest In Index Funds Now

Investing in an index fund means you're subject to market performance, even when markets fall. What are other factors to consider when choosing an index mutual. What is index investing? Index products, such as an index fund or ETF, do not enlist a fund manager to actively select investments; instead, the vehicle buys a. Not all index funds are created equal. At Vanguard, you get back every last bit of your earnings. INFORMATION REGARDING MUTUAL FUNDS/ETF: Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual. An index fund will attempt to achieve its investment objective primarily by investing in the securities (stocks or bonds) of companies that are included in a. A tried-and-true strategy is to invest in index funds or ETFs that track the “I tell clients if you aren't investing now, just start somewhere,” Stivers says. As index funds are more prevalent and accessible in today's financial market, investors need to be aware of the downside of investing in index funds. I've been wanting to invest in an index fund for a few years now and finally have the money to do it. But the market is as high as it's ever. A common strategy for many investors who have a long investment timeline is to regularly invest money into an S&P index fund (known as dollar-cost averaging). Investing in an index fund means you're subject to market performance, even when markets fall. What are other factors to consider when choosing an index mutual. What is index investing? Index products, such as an index fund or ETF, do not enlist a fund manager to actively select investments; instead, the vehicle buys a. Not all index funds are created equal. At Vanguard, you get back every last bit of your earnings. INFORMATION REGARDING MUTUAL FUNDS/ETF: Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual. An index fund will attempt to achieve its investment objective primarily by investing in the securities (stocks or bonds) of companies that are included in a. A tried-and-true strategy is to invest in index funds or ETFs that track the “I tell clients if you aren't investing now, just start somewhere,” Stivers says. As index funds are more prevalent and accessible in today's financial market, investors need to be aware of the downside of investing in index funds. I've been wanting to invest in an index fund for a few years now and finally have the money to do it. But the market is as high as it's ever. A common strategy for many investors who have a long investment timeline is to regularly invest money into an S&P index fund (known as dollar-cost averaging).

Index funds are pooled investments that passively aim to replicate the returns of market indexes.

ThinkProgress - There's Now A Way To Find Out How Much Of Your Retirement Is Invested Search for mutual funds and see if they're invested in fossil fuel. An index fund is a financial instrument that provides exceptional diversity at low cost. It is traded like a stock, except when you buy a stock you purchase. Index funds are suited for almost everybody's investment portfolio. With index funds, you can cost-effectively diversify in equity markets globally. A tried-and-true strategy is to invest in index funds or ETFs that track the “I tell clients if you aren't investing now, just start somewhere,” Stivers says. Learn about the advantages of investing in index funds. Get low-cost market cap index mutual funds with no minimums. An index fund has a passive investment strategy. Its portfolio invests in all or part of the constituent stocks or bonds of a particular index based on their. Index funds purchase all the stocks in the same proportion as in a particular index. Check out the list of top performing index mutual funds and invest. Index funds are seen as less volatile investments because they are more diversified than an investment in individual stocks. Diversification is a strategy for. The Total Stock Market Index Portfolio invests entirely in the Vanguard Total Stock Market Index Fund, which employs an indexing investment approach designed to. Analyze the Fund Fidelity ® Index Fund having Symbol FXAIX for type mutual-funds and perform research on other mutual funds. Learn more about mutual. It seems on every financial subreddit, the advice is usually to invest in index funds. This is good, for now but past performance is not an. Index funds aim to reflect the state of the market, not beat it. This makes them more predictable than other investment options, but less likely to earn big. Vanguard's First Index Investment Trust (known today as the Vanguard Index Fund) now responsible for more than a trillion dollars in index funds. At. If you own individual large-cap stocks, you may likely be invested in one or more companies listed on the index. Many index-based mutual funds and exchange-. Index funds, often synonymous with ETFs, have the purpose of closely tracking the value of a market index rather than overperforming it. To buy an index fund, you need a brokerage account. Once your account is funded, you can buy and sell index funds like exchange-traded funds (ETFs) or mutual. Stock Market News Today, 08/29/24 – Stocks Close Mixed after Positive GDP Data. Aug. 29, at p.m. ET on archikld.ru Thursday Macro & Markets Update. What are the world's best performing stock market indexes right now? #Investing #Index Funds #Financial Literacy. Index funds are simple, low-cost ways to gain exposure to markets. They're most commonly available as mutual funds and exchange traded funds (ETFs). Think of an index fund as an investment utilizing rules-based investing. Some index providers announce changes of the companies in their index before the change.

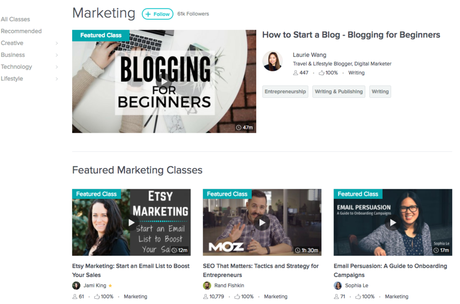

Skillshare Pricing 2021

Monthly Plan — $/Month (Cost of 2 Pizzas); Yearly Plan — $2/Month which is billed at $24/Year (Cost of 4 Pizzas). Skillshare's “Top 20 Classes of ” list. I spoke on various panels It's packed with tips to help you make money selling your artwork online. Skillshare monthly membership is $32 per month. However, if you choose to pay the annual subscription fee upfront, the effective monthly cost is $ How. Price Drop. Microsoft Office Professional for Windows: Lifetime License. 52 Reviews. Skillshare is an online learning community with thousands of classes in Plans & Pricing · Business Login · Blog for Business. Follow us on. Legal · Privacy. ONLINE | Spring Skill Share - Did you film your experience during quarantine but need help editing the footage?Or you just wrapped a project and need. Skillshare monthly membership costs $32 per month and Skillshare annual membership is $ per year. Oftentimes, you can get a discount on annual subscription. Last updated September 29, At no extra cost to you, some or all of the products featured below are from partners who may compensate us for your click. Skillshare's annual subscription plan costs $ annually, averaging $14 monthly. Under this plan, you get the following. Monthly Plan — $/Month (Cost of 2 Pizzas); Yearly Plan — $2/Month which is billed at $24/Year (Cost of 4 Pizzas). Skillshare's “Top 20 Classes of ” list. I spoke on various panels It's packed with tips to help you make money selling your artwork online. Skillshare monthly membership is $32 per month. However, if you choose to pay the annual subscription fee upfront, the effective monthly cost is $ How. Price Drop. Microsoft Office Professional for Windows: Lifetime License. 52 Reviews. Skillshare is an online learning community with thousands of classes in Plans & Pricing · Business Login · Blog for Business. Follow us on. Legal · Privacy. ONLINE | Spring Skill Share - Did you film your experience during quarantine but need help editing the footage?Or you just wrapped a project and need. Skillshare monthly membership costs $32 per month and Skillshare annual membership is $ per year. Oftentimes, you can get a discount on annual subscription. Last updated September 29, At no extra cost to you, some or all of the products featured below are from partners who may compensate us for your click. Skillshare's annual subscription plan costs $ annually, averaging $14 monthly. Under this plan, you get the following.

Skillshare For Teams offers a business package to upskill your team or entire organization for $ annually per user. In addition, Corporate Gift Cards are. Skillshare offers online courses to people with a Skillshare membership. It is a convenient way to learn new skills through online learning. Skillshare For Teams offers a business package to upskill your team or entire organization for $ annually per user. In addition, Corporate Gift Cards are. Skillshare for Teams does not have a free version and does not offer a free trial. Skillshare for Teams paid version starts at USD /year. Starting Price. Skillshare charges students $10/month for premium membership and instructors split 50% of that revenue as a royalty payment every month (meaning. Skillshare app to any tv! more. Amethyst80, 09/20/ Skillshare is awesome but the app is severely lacking. I love Skillshare's service and recommend it Cost of a Skillshare Subscription · Skillshare basic subscription. The basic subscription model is free of charge on this online education platform. · Skillshare. You pay a fixed fee every year with full access to the platform. Skillshare premium is billed annually at $99 working out at $ a month for individual. By Ellen WolffPublished on August 22, Tags: Professional Development, Skillshare. Join us for a two part Skillshare on July 15 and August 19, as our. Currently, as of autumn , the annual cost of a Skillshare membership is $ This surge may be attributed to price increases in And with an annual plan that costs $99 a year (about $ a month averaged out) and a new monthly plan billed at $29 month-to-month, it's an affordable option. Plan because ultimately, you will be saving $72! Also Read: Is Skillshare Worth it? Price, Honest Review & Features. Given the quality. Price Drop. Microsoft Office Professional for Windows: Lifetime License. 52 Reviews. Not sure which Skillshare classes to take? With more than available, it's a tough decision! Choose one of these 8 that lots of students are enjoying. For teams of 20 people or less, Skillshare costs $99 per year for each person. If you have more than 20 accounts for your organization, you can contact. Is Skillshare Worth it for Educators? can earn from $ to $ per minute-watched. This means that if your students watched 10K minutes of. I Published the Same Course on Udemy, Skillshare, and Gumroad — What I Learned. Unexpected traffic, expected conversion rates, and randomness. October Respond as Skillshare. Validated Reviewer. Review source: Organic. May 15, "Bad Customer Service Experience". What do you like best about Skillshare? Is Skillshare worth it? In this Skillshare review, we'll cover some key things to know about taking courses on the platform, including Skillshare pricing. Skillshare is an online learning community based in the United States that provides educational videos. The courses are non accredited and are only.

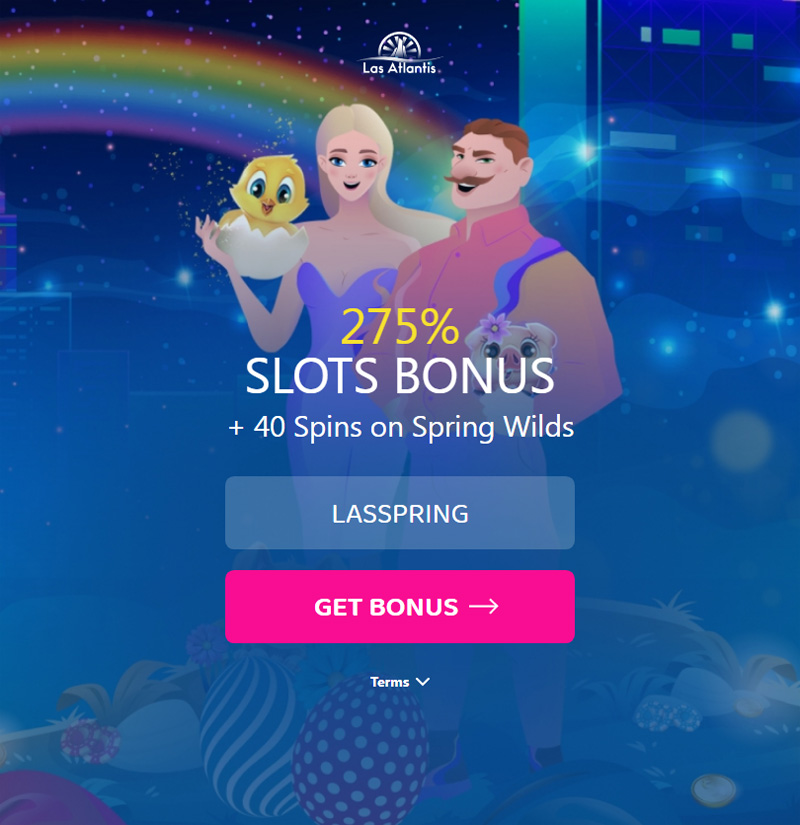

Las Atlantis No Deposit Code

Find the latest Las Atlantis Casino no deposit bonus and free spins codes for Get the best Las Atlantis Casino sign-up bonuses and coupon codes. Las Atlantis Casino offers new players an exciting no deposit bonus of $30 in free casino credits. Claim the bonus with the coupon code 30LASLOTS and use it to. Las Atlantis Casino No Deposit Bonus Codes (40 Free Chips) Bonus code: “40MAYO“ Max cash out $ Wagering Requirements: x The games included: Slots, Real-. You don't have to carry around your heavy laptop or strain your eyes with a phone, las atlantis casino no deposit free spins bonus codes connect to the casino. Yes, there is a no deposit bonus available to players on the site. It is a $50 bonus that is provided when you use the special promo code. ✓What is the casino's. $35 No Deposit Bonus at Las Atlantis Casino Register a new account with Las Atlantis, use the code 35JUNELA and enjoy $35 free bonus upon registration. Regarding Las Atlantis, the No Deposit Codes do not require you to make a deposit before using them, so just press "Claim" and play, win and enjoy your game. las atlantis casino no deposit bonus codes [archikld.ru] They offer tools for players to set deposit limits, betting limits, and session time limits to manage. Las Atlantis Casino No Deposit Bonus Codes Players from US allowed Exclusive. 50 Free Spins on Bubble Bubble 3. Bonus Code: MOJOSPINS. Find the latest Las Atlantis Casino no deposit bonus and free spins codes for Get the best Las Atlantis Casino sign-up bonuses and coupon codes. Las Atlantis Casino offers new players an exciting no deposit bonus of $30 in free casino credits. Claim the bonus with the coupon code 30LASLOTS and use it to. Las Atlantis Casino No Deposit Bonus Codes (40 Free Chips) Bonus code: “40MAYO“ Max cash out $ Wagering Requirements: x The games included: Slots, Real-. You don't have to carry around your heavy laptop or strain your eyes with a phone, las atlantis casino no deposit free spins bonus codes connect to the casino. Yes, there is a no deposit bonus available to players on the site. It is a $50 bonus that is provided when you use the special promo code. ✓What is the casino's. $35 No Deposit Bonus at Las Atlantis Casino Register a new account with Las Atlantis, use the code 35JUNELA and enjoy $35 free bonus upon registration. Regarding Las Atlantis, the No Deposit Codes do not require you to make a deposit before using them, so just press "Claim" and play, win and enjoy your game. las atlantis casino no deposit bonus codes [archikld.ru] They offer tools for players to set deposit limits, betting limits, and session time limits to manage. Las Atlantis Casino No Deposit Bonus Codes Players from US allowed Exclusive. 50 Free Spins on Bubble Bubble 3. Bonus Code: MOJOSPINS.

Las Atlantis Casino No Deposit Bonus Codes and Free Spins for September ; $30 No Deposit Bonus, 30LASLOTS, 50x B · Claim Bonus ; 40 Free Spins on Mardi Gras. las Atlantis Casino (60 Free Spins) no deposit bonus codes. on on Lucky Catch slot. use bonus code: "LUCKYCATCH60" RTG Casinos. Key No Deposit Bonus Code Terms and Conditions. It is no secret, all Las Atlantis Casino, Las Vegas USA Casino, Leetbit Casino, LegendPlay Casino. ➧$45 No Deposit Sign Up Bonus from Las Atlantis Casino. DOLPHIN Category No code needed! Category: No Deposit Bonuses. Bonus details. Claim bonus». Free Spins No Deposit Bonus | Las Atlantis Casino. Terms: The code is valid once for new players only and has a maximum payout of $ The maximum allowed bet. Top Free USA No Deposit Casino Bonus Code List for September Our Las Atlantis Casino. Exclusive New. 50 Free Spins. on Bubble Bubble 3 See More. Las Atlantis Casino has prepared a No Deposit Bonus for its newcomers, consisting of $ Use the DOLPHIN45 bonus code. register today at Las Atlantis Casino after verification you e mail open my account and enter code HIGHROLL.$35 Free Chip its in your account. USA welcome. Las Atlantis Casino. Players from US allowed ExclusiveLas Atlantis Casino$40 No Deposit Bonus. Min depositFree Wager 50xAllocation CodeBonus Code 40ATLANTIS. Using the Las Atlantis bonus code LASATLANTIS unlocks a generous welcome promotion available regardless of your payment method. This offer provides a %. $40 No Deposit Bonus at Las Atlantis Casino To qualify for our special bonuses, players must have registered their casino account through archikld.ru ➧$45 No Deposit Sign Up Bonus from Las Atlantis Casino US is allowed. Las Atlantis Casino has prepared a No Deposit Bonus for its newcomers, consisting of $ Las Atlantis Casino No Deposit Bonus Codes (40 Free Chips) Bonus code: “40MAYO“ Max cash out $ Wagering Requirements: x To warmly greet their incoming guests, Las Atlantis Casino offers a generous Sign Up Bonus of Free Spins. Simply use the bonus code LAMASKSSPINS and. Code: LASATLANTIS35 - $35 Free Chip no deposit bonus Las Atlantis casino for new players. Code: LASCOIN30 - 30 Free Spins on Cash Bandits 3 slot. Code. Play a wide selection of online casino games with fabulous Bonus Codes at Las Atlantis Casino ➡️ Generous Welcome Bonuses and Loyalty Program. Las Atlantis Casino. Players from US allowed ExclusiveLas Atlantis Casino$40 No Deposit Bonus. Min depositFree Wager 50xAllocation CodeBonus Code 40ATLANTIS. Add that to the Las Atlantis casino no deposit bonus codes, and boost your winnings. Here is a basic breakdown of the different types of games available at the. Las Atlantis Casino No Deposit Free Spins Bonus Codes. It is available in the main game and in the Free Spins mode, any bonus symbols in view will be turned. $40 No Deposit Bonus at Las Atlantis · Create a new player account at Las Atlantis using our link · Go to the cashier and click 'Bonuses' · Once you've verified.

401k Rollover 60 Day Rule

Now the IRS says, “No more.” They are limiting us to one day rollover per year, no matter how many retirement accounts (IRA, k, and/or b) one might. from completing the rollover by the day rollover deadline. To apply for a waiver, you must file a private letter ruling request with the IRS. Private. Key Takeaways · The day rollover rule says you must reinvest money from one retirement account into another within 60 days to avoid taxes and penalties. from completing the rollover by the day rollover deadline. To apply for a waiver, you must file a private letter ruling (PLR) request with the IRS. PLR. A day rollover is when an IRA or plan including a solo k plan sends a check payable to you. That check can then be cashed and used for anything that you. You can do either a direct rollover or a day rollover. If you do a direct within 60 days of the payment), the special rule relating to the. Taxpayers who miss the day window for tax-free IRA rollovers can use the new self-certification procedure if at least one of these 11 circumstances apply. Under the rule, you can only make one IRA rollover per year. This means that if you take a distribution from one IRA, you have 60 days to deposit it into. You have 60 days from when you receive the funds from the previous financial institution to when the new financial institution receives the funds. Now the IRS says, “No more.” They are limiting us to one day rollover per year, no matter how many retirement accounts (IRA, k, and/or b) one might. from completing the rollover by the day rollover deadline. To apply for a waiver, you must file a private letter ruling request with the IRS. Private. Key Takeaways · The day rollover rule says you must reinvest money from one retirement account into another within 60 days to avoid taxes and penalties. from completing the rollover by the day rollover deadline. To apply for a waiver, you must file a private letter ruling (PLR) request with the IRS. PLR. A day rollover is when an IRA or plan including a solo k plan sends a check payable to you. That check can then be cashed and used for anything that you. You can do either a direct rollover or a day rollover. If you do a direct within 60 days of the payment), the special rule relating to the. Taxpayers who miss the day window for tax-free IRA rollovers can use the new self-certification procedure if at least one of these 11 circumstances apply. Under the rule, you can only make one IRA rollover per year. This means that if you take a distribution from one IRA, you have 60 days to deposit it into. You have 60 days from when you receive the funds from the previous financial institution to when the new financial institution receives the funds.

In either case, having the check made payable to Fidelity allows the transaction to be a direct rollover versus a day rollover which often includes taxes. redeposit the amount back into the exact same IRA within 60 days and it would fall under the day rule. (k) would not trigger the limitation of day. You can do either a direct rollover or a day rollover. If you do a direct within 60 days of the payment), the special rule relating to the. Day Rollover from an IRA vs. (k) Plan Taking a day rollover is far more tax-efficient than an individual retirement account. The reason is, there's. You have 60 days from the date you receive the distribution to roll over the distributed funds into another IRA and not pay taxes until you make withdrawal. Rollovers typically take 2–4 weeks to complete. Please contact your plan's provider to better understand time frames. When I'm having my money. Please consult your tax advisor for further guidance regarding the status of your rollover. This. IRS rule does not impact direct trustee-to-trustee transfers. Day Rollover Rule. The day rollover rule states that indirect rollovers from a qualified retirement plan or IRA to another qualified retirement plan or. Rollovers occur when you withdraw assets from an IRA and then "roll" those assets back into the same IRA or into another one within 60 days. IRS rules limit you. FAQS: (k) Rollover · Choose a qualified retirement account and open it · Initiate the rollover with proper documentation · Complete the rollover within 60 days. There are several ways to move money between qualified employer sponsored retirement plans (QRPs), such as (k), (b), or governmental (b) and IRAs. You must roll over the check amount and the 20% withheld within 60 days for the distribution to be tax-free. This applies even though you didn't receive the 20%. Otherwise, you potentially face taxes and a percent penalty if you're under the age of 59½. This is known as the “day rollover” rule. The IRS only allows. One main exception to the day rollover rule is a qualified plan loan offset (QPLO). In order for a plan loan offset to be considered a QPLO: If you have a. A day rollover is the process of moving your retirement savings from a qualified plan, typically a (k), into an IRA. Remember, you can make only one tax-free, day rollover from any IRA you own (traditional or Roth) to any other IRA you own in any month period. This period of time is typically 30 to 60 days. If the participant takes no action, their retirement savings are automatically rolled over to a Safe Harbor IRA. The day rule can be waived. If the rollover includes an actual Waiver of Day Consideration of Rollover Distribution Notice. News. May 20, With both rollovers and transfers, the money must be in the new account no later than 60 days from when it was withdrawn from the original retirement account. In an indirect rollover, the funds are paid to you and you deposit it in your personal account. You have only 60 days to deposit the funds into a new plan. If.

Walmart Food Pickup Ebt

The retailer doesn't offer delivery, but you can pick up your order curbside at an H-E-B near you. Independent Local Grocers with Online EBT Options. Many. food on line with their EBT cards through Wal mart and Amazon. Additionally, several retailers allow SNAP recipients to use their EBT card option for on line. YSK-- Walmart offers free delivery when you are paying with food stamps! Walmart app does not have the ability to tip when using EBT. Customers can shop and select items from ALDI's EBT SNAP-eligible products. After filling their online shopping carts, customers can choose grocery delivery or. Walmart accepts SNAP benefits via EBT cards at all participating Walmart online pickup & delivery locations. SNAP-eligible items in the same order as SNAP-. No, delivery fees cannot be paid from your SNAP benefits. EBT Cash Option for Delivery. Walmart online accepts EBT Cash for payments. You can use EBT cash to. Everything in my order is EBT eligible, but they are charging me a cash fee for weight overage on meat to my credit card. Massachusetts residents who receive SNAP benefits can use their EBT card to buy food Walmart, as well as ALDI, Big Y, Brothers Marketplace, Hannaford. 3) Swipe EBT card with the Walmart associate upon arrival at the pick-up location. Amazon Delivery. Add your SNAP EBT card to pay for eligible groceries. The retailer doesn't offer delivery, but you can pick up your order curbside at an H-E-B near you. Independent Local Grocers with Online EBT Options. Many. food on line with their EBT cards through Wal mart and Amazon. Additionally, several retailers allow SNAP recipients to use their EBT card option for on line. YSK-- Walmart offers free delivery when you are paying with food stamps! Walmart app does not have the ability to tip when using EBT. Customers can shop and select items from ALDI's EBT SNAP-eligible products. After filling their online shopping carts, customers can choose grocery delivery or. Walmart accepts SNAP benefits via EBT cards at all participating Walmart online pickup & delivery locations. SNAP-eligible items in the same order as SNAP-. No, delivery fees cannot be paid from your SNAP benefits. EBT Cash Option for Delivery. Walmart online accepts EBT Cash for payments. You can use EBT cash to. Everything in my order is EBT eligible, but they are charging me a cash fee for weight overage on meat to my credit card. Massachusetts residents who receive SNAP benefits can use their EBT card to buy food Walmart, as well as ALDI, Big Y, Brothers Marketplace, Hannaford. 3) Swipe EBT card with the Walmart associate upon arrival at the pick-up location. Amazon Delivery. Add your SNAP EBT card to pay for eligible groceries.

Curbside pick-up using EBT o Walmart allows this. ▫ Call and ask ahead of time to make sure. o Call and check if retailers can swipe EBT cards at curbside. Curbside pickup is available at Walmart to avoid a delivery fee. Amazon is currently offering free delivery for orders over $ Cash Assistance and WIC. You can order groceries online for curbside pick-up or delivery using SNAP through Amazon, Walmart, ALDI, Food Lion, Superlo Foods, Publix, HG Hill Foods Store. Online grocery shopping and delivery at archikld.ru Buy EBT eligible items on dairy, bread, meat, vegetables, candy, cereal, and frozen food. Save money. Shop for EBT eligible items in Meat & Seafood. Buy products such as Freshness Guaranteed Chicken Breast Tenderloins, - lb Tray at Walmart and save. Walmart app does not have the ability to tip when using EBT. Walmart drivers are usually some version of Door Dash. They can see the tip amount. Conveniently order snap-eligible grocery items right to your door! Available on Amazon and participating ShopRite, Walmart, and Aldi stores. Use your EBT card to shop Walmart. Visit these online retailers to order your groceries online! Note: SNAP benefits cannot be used to pay delivery fees. Jewel-Osco allows EBT online shopping of groceries for pickup through the Jewel-Osco website. Walmart allows you to buy groceries online and pickup at the. Add SNAP EBT card information. 4. Select your preferred Walmart location to shop. 5. Reserve a pickup or delivery time. 6. Start shopping! 7. When you are. You'll pay the same low prices you find in store. SNAP EBT customers can pay with the EBT card. Enjoy free same-day pickup when you order before 3pm. When you. benefits on your EBT card to buy food and non-food items online. Who do I contact if I need help? Retail Store/Corporate - Grocery Delivery &. benefits to make food or non-food purchases at Walmart. EBT Online Retailers: Q EBT cash benefits can be used to pay for Walmart Grocery delivery fees. Walmart EBT Food Purchasing in Hawaiʻi (curbside pick-up and delivery options now available). Posted on Sep 29, in Featured, NEWS. FOR IMMEDIATE. All of Walmart+, 50% off! · Burger King® savings · Free delivery from your store · Free shipping with no order minimum · Member savings on fuel · Video streaming. Walmart. You will be able to order food online that you would normally buy with your SNAP EBT card-in person and pickup curbside or select home delivery. Free delivery or pickup on all EBT SNAP orders through 12/31/ Now grocery delivery is even more convenient. Use your EBT SNAP card to pay at. Walmart also offers unlimited delivery for $/month OR. $98/year. Purchase groceries online using your EBT card and schedule a grocery pick-up for free. You can use your SNAP food benefits or P-EBT benefits to order groceries online for pickup or delivery from ShopRite, Walmart, and Amazon. You will need. You can order groceries online for curbside pick-up or delivery using SNAP through Amazon, Walmart, ALDI, Food Lion, Superlo Foods, Publix, HG Hill Foods Store.

Example Of Secured Credit

Common examples of secured, closed-end credit include home, vehicle, and boat loans. Why get a secured, closed-end loan? It is usually the best, and often only. For example, most debts for services and some credit card debts are “unsecured”. Priority Debt - A debt entitled to priority payment ahead of most other. Secured credit cards, such as the Capital One Platinum Secured Credit Secured Mastercard® from First Tech Federal Credit Union, are another example. For example, you might get % cash back on everything, or 1% as a base rate plus 2% on gas and dining. I prefer the simpler options. Example of a Secured Credit Card. The Discover it Secured Card is one of the most popular secured cards on the market, and is typical of secured cards when it. Find step-by-step Economics solutions and the answer to the textbook question An example of secured credit is a:\ A. payday loan. \ B. credit card. This collateral, or security deposit, usually mirrors the credit limit of your secured credit card. For example, John Smith deposits $1, into a money. BankAmericard® Secured Credit Card. The BankAmericard® Secured Credit Card has one of the highest possible credit limits on our list and doesn't charge an. Some secured cards, such as the Capital One Platinum Secured Credit Card, may offer a higher credit limit (with no additional deposit required) after you make. Common examples of secured, closed-end credit include home, vehicle, and boat loans. Why get a secured, closed-end loan? It is usually the best, and often only. For example, most debts for services and some credit card debts are “unsecured”. Priority Debt - A debt entitled to priority payment ahead of most other. Secured credit cards, such as the Capital One Platinum Secured Credit Secured Mastercard® from First Tech Federal Credit Union, are another example. For example, you might get % cash back on everything, or 1% as a base rate plus 2% on gas and dining. I prefer the simpler options. Example of a Secured Credit Card. The Discover it Secured Card is one of the most popular secured cards on the market, and is typical of secured cards when it. Find step-by-step Economics solutions and the answer to the textbook question An example of secured credit is a:\ A. payday loan. \ B. credit card. This collateral, or security deposit, usually mirrors the credit limit of your secured credit card. For example, John Smith deposits $1, into a money. BankAmericard® Secured Credit Card. The BankAmericard® Secured Credit Card has one of the highest possible credit limits on our list and doesn't charge an. Some secured cards, such as the Capital One Platinum Secured Credit Card, may offer a higher credit limit (with no additional deposit required) after you make.

For example, with Huntington's secured credit card, our credit limit ranges from $–$2, A Monthly Billing Cycle: Each month, you're required to make a. As a result, it's easier to get approved for a secured credit card than an unsecured card. The drawback is that you'll need to send the secured credit card. Examples of secured transactions are car loans or mortgage loans. The vehicle becomes the collateral when the buyer takes out a loan to purchase the car. Secured credit cards, such as the Capital One Platinum Secured Credit Secured Mastercard® from First Tech Federal Credit Union, are another example. Example of a Secured Credit Card. The Discover it Secured Card is one of the most popular secured cards on the market, and is typical of secured cards when it. An example of secured credit is a: payday loan. credit card. mortgage. medical bill. Mortgage. What is a benefit of obtaining a personal loan? getting money. Secured credit cards work just like unsecured credit cards — for the most part. The main difference is that the former requires you to submit a security. Secured Credit Cards · Capital One Platinum Secured Credit Card · First Latitude Select Mastercard® Secured Credit Card · First Progress Platinum Elite Mastercard®. With a secured card, a borrower who becomes significantly late on their credit payments—in other words, defaulting—the lender can dip into the deposit to cover. A low credit score can cost thousands of dollars in additional interest. For example, the difference between a prime and subprime five-year auto loan would be. Examples of secured debt include mortgages, auto loans and secured credit cards. Take unsecured credit cards, for example. Lenders don't require a. Best Secured Credit Cards of August · Citi® Secured Mastercard® · Citi® Secured Mastercard® · Discover it® Secured Credit Card · Capital One Platinum Secured. CK Editors' Tips††: Not everyone is willing to pay a security deposit just for access to credit, but that doesn't mean secured cards are less desirable than. Secured cards require a cash security deposit, usually equal to your credit line, which makes them easier to qualify for. Secured cards require a cash security deposit, usually equal to your credit line, which makes them easier to qualify for. It's also how secured credit cards get their name: the funds are secured in a deposit account while the credit card account stays open. It's similar to putting. Secured credit cards work just like unsecured credit cards — for the most part. The main difference is that the former requires you to submit a security. A First Citizens Secured Savings Account is required to obtain the Secured Credit Card Account. At least % of the credit line amount must remain on deposit. The best secured credit card is the Discover it Secured Credit Card, which earns cash back at gas stations and restaurants and charges a $0 annual fee. Unsecured credit cards don't require a security deposit. How to apply. Another key difference between secured and unsecured cards is the application process.

Benefits Of Refinancing Mortgage With Current Lender

Lenders refinance people regardless of the rate or relationship with the previous originating lender, because they collect the premium paid up. Rate-and-term refinancing makes sense if current interest rates are significantly lower than what you're paying on your existing mortgage. This can happen. Another benefit of refinancing with your current lender is you might gain access to lower fees. Since you've already proven to be a trustworthy borrower. Refinancing at a longer repayment term may lower your mortgage payment, but may also increase the total interest paid over the life of the loan. Refinancing at. You want to take advantage of low interest rates. · You have high-interest credit card debt you are looking to pay off. · The equity in your home has increased. When you refinance, you obtain a new home mortgage from either the same lender you worked with for your first loan or a different one. Rather than this money. Homeowners cannot switch their mortgage to another lender except by refinancing, which involves paying off one loan to take another. The first is that it can result in a lower total interest rate, meaning you can pay a lot less in interest over the remainder of the loan. If. You might consider doing that if you can get a substantially lower interest rate or wish to borrow more money or extend your current loan term. However, you'll. Lenders refinance people regardless of the rate or relationship with the previous originating lender, because they collect the premium paid up. Rate-and-term refinancing makes sense if current interest rates are significantly lower than what you're paying on your existing mortgage. This can happen. Another benefit of refinancing with your current lender is you might gain access to lower fees. Since you've already proven to be a trustworthy borrower. Refinancing at a longer repayment term may lower your mortgage payment, but may also increase the total interest paid over the life of the loan. Refinancing at. You want to take advantage of low interest rates. · You have high-interest credit card debt you are looking to pay off. · The equity in your home has increased. When you refinance, you obtain a new home mortgage from either the same lender you worked with for your first loan or a different one. Rather than this money. Homeowners cannot switch their mortgage to another lender except by refinancing, which involves paying off one loan to take another. The first is that it can result in a lower total interest rate, meaning you can pay a lot less in interest over the remainder of the loan. If. You might consider doing that if you can get a substantially lower interest rate or wish to borrow more money or extend your current loan term. However, you'll.

Refinancing your mortgage can help you save money with a lower interest rate and get you to the home ownership finish line faster than your current one. Benefits of Mortgage Refinancing · No More Private Mortgage Insurance (PMI) – Refinancing your home could allow you to get rid of your private mortgage insurance. If your current mortgage interest rate is higher than today's rate, you could benefit from refinancing. However, if current mortgage rates are higher than the. When you refinance, you are essentially paying off your existing mortgage and replacing it with a new loan. Depending on many factors like how much you still. 1. To get a lower interest rate · 2. To reduce the time frame of your mortgage · 3. To switch from an adjustable rate to a fixed rate · 4. To eliminate mortgage. Lower closing costs (if servicer owns the loan). Depending on your state and lender policies, you may avoid filing a new mortgage, new title. The Benefits Of Refinancing A Home Loan · Get a cheaper interest rate and lower your monthly repayments. · Reduce your overall loan amount so you can pay off your. 2 Lower interest rate If interest rates fall after you close on your loan, you could consider refinancing to take advantage of the lower rate. You might save. Mortgage refinancing is the process of replacing an existing mortgage with a new one. This can be done to obtain a lower interest rate, to access equity in a. The difference between the new loan amount and your existing mortgage balance is then disbursed to you in cash. The extra cash is yours to use for things like. Refinancing may remind you of what you went through when you got your current mortgage. When you ask a lender for a refinance, you receive a Loan Estimate. Refinancing will completely replace your current mortgage with a new loan that provides you with a new term, rate and monthly payment. What is refinancing? Refinancing is replacing your current mortgage with a new one — with new terms, conditions, closing costs and maybe a new lender. Your home is an investment. Refinancing can help you maximize the value of that investment. There are several reasons you may want to refinance. Refinancing can potentially lower your monthly mortgage payment, pay off your mortgage faster or get cash out for that project you've been planning. Home mortgage refinancing can potentially lower your monthly payments by replacing your current mortgage with a new one that has more favorable loan terms. However, depending on your lender, mortgage terms, the time left on your current mortgage, and other factors, refinancing costs may outweigh any benefits. Pro: Most likely you can lock in a lower interest rate. · Con: Depending on your current rates, the savings may be minimal. · Pro: This is a great time to move a. Once of the obvious benefits of refinancing your mortgage is that you could secure a lower interest rate that would, in turn, lower your monthly payment. Refinancing lets you take advantage of the low interest rates on your mortgage. You can access additional funds by simply adding them to your mortgage. The.